Trade between blockchains.

No bridging required.

L1DEX leverages the ground breaking interoperability of L1X to bring you the worlds first truly decentralized cross-chain exchange. Swap any token for any other token across blockchains without the use of bridges.

Supported networks:

Lowest on chain fees

$0.01

Transactions per second

100K

Network block creation time

500ms

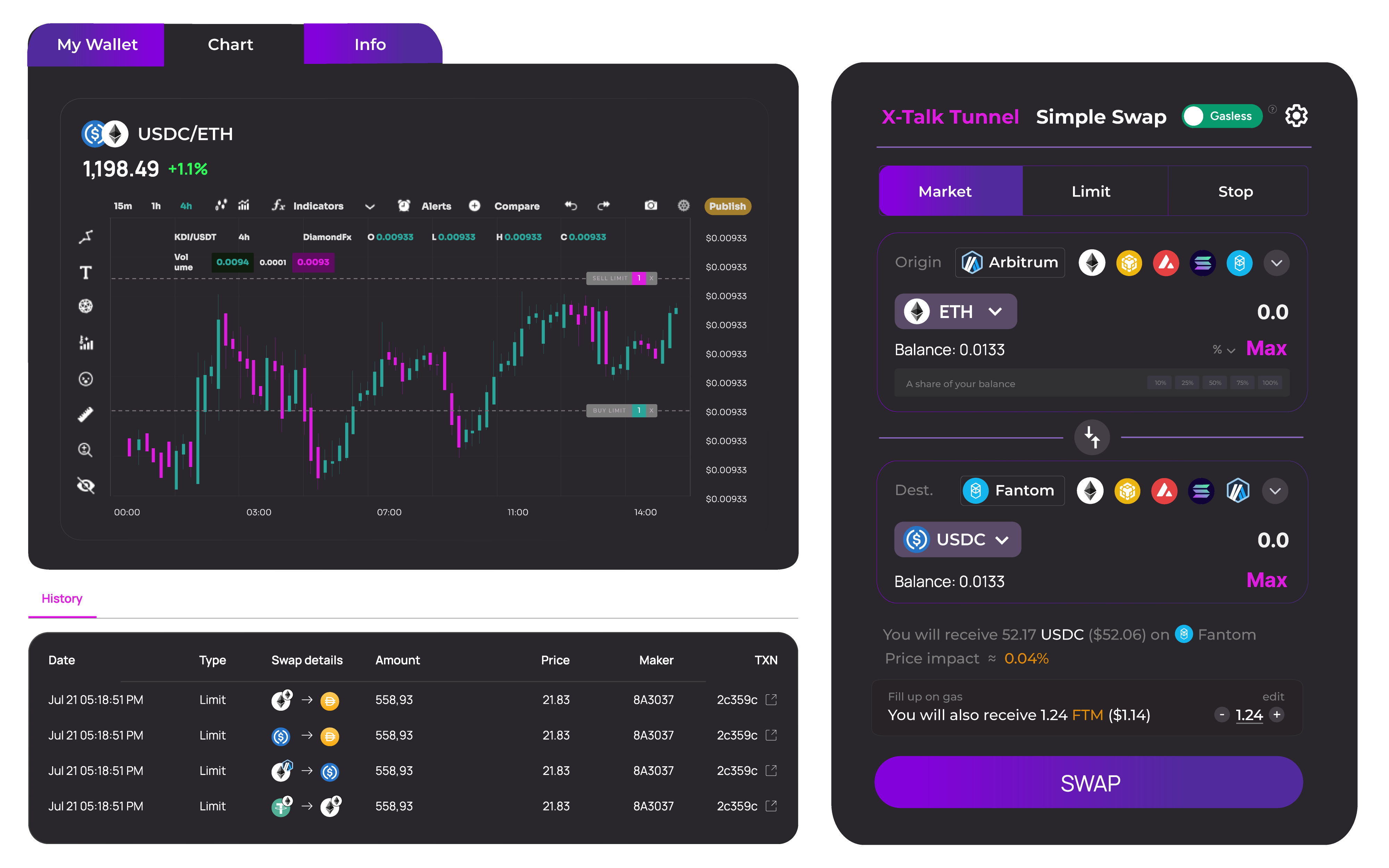

1Direct wallet integrations

to view and access

your wallet in app

without switching tabs.

to view and access

your wallet in app

without switching tabs.

2Real time routing information,

price/slippage impact, etc…

in real time on every trade.

price/slippage impact, etc…

in real time on every trade.

3With optional gasless trades,

users can trade any

token on any chain

without maintaining

native tokens.

users can trade any

token on any chain

without maintaining

native tokens.

4Trade like a pro with

advanced order placement

including limit & stop orders.

advanced order placement

including limit & stop orders.

5Save your technical

analysis on-chart

while you trade.

analysis on-chart

while you trade.

6Efficient trading with

one-click drag and

drop stop and limit orders.

one-click drag and

drop stop and limit orders.

7Simple UX for trading a

percentage of your holdings.

percentage of your holdings.

8Effortlessly switch between

networks as you swap

from chain to chain.

networks as you swap

from chain to chain.

9Optionally send along

additional gas money to

the destination chain.

additional gas money to

the destination chain.

10Monitor market trades,

track open orders &

view individual trade history.

track open orders &

view individual trade history.

Powered by:

Powered by: